Claims adjusters investigate insurance claims by interviewing the claimant and witnesses, consulting police and hospital records, and inspecting property damage to determine the extent of the company's liability. In the United Kingdom, Ireland, Australia, South Africa, the Caribbean and New Zealand the term loss adjuster is used. Other claims adjusters who represent policyholders may aid in the preparation of an insurance claim.

Generally, in the United States a claim adjuster duties should include the following elements:

- Verify an insurance policy written by the insurance company exists for the insured person and/or property.

- Investigate the circumstances and the sequence of events leading up to the claimed damages occurring as the result of someones negligence or risks of direct physical loss or damages to property, culminating in the loss of property and or bodily injury.

- After obtaining the above investigation evaluate the covered injury and or damages that have been determined according to the coverage grants.

- Negotiate a settlement according the applicable law, coverage insured for following best insurance practices.

In casualty insurance the main type of coverages include but may not be limited to the followings:

- First party auto and other than auto coverages (sometime referred to collision and comprehensive coverages) there are numerous types of first party insurance coverages for any kind of risk of loss or damages.

- Third party liability for property damage of others property and bodily injury. ( in law terms these are "tort" claims)

Key words to define via a hot link. Investigation, risk of loss, negligence, third party, first party and property damages. Insurance best practices and tort.

Classes

- Claim service representatives (employed by the insurance company, or an independent adjusting company).

In the two first instances, and the fourth, the adjuster operates on behalf of the insurer.

Adjusters may handle "property claims" involving damage to buildings and structures, or "liability claims" involving personal injuries or third-person property damage from liability situations, such as motor vehicle accidents, slip and falls, dog bites, or alleged negligent behavior. Some adjusters handle both types of claims and are known as "Multi-Line" adjusters. Also "All Lines Adjusters" may handle "any" type of claim already identified and also include professional liability, Hospital Professional Liability, Excess Liability, Physicians and Surgeons Liability, Aircraft Liability/Hull, Inland Marine, Ocean Marine, Boiler and Machinery, as well as various types of Bond Losses.

Public adjusters work exclusively for the policyholder. This means there should be no inherent conflict of interest when it comes to advocating on the policyholder's behalf to the insurance company.

An independent adjuster could be working for multiple insurance companies or self-insured entities. If licensed by state authority they represent pinnacle of property loss knowledge in their field; whether it be residential, vehicular, marine, etc.

An adjuster will frequently verify that coverage applies through an insurance policy, investigate liability for the damages caused, and make compensation to the injured person based on their emotional or physical property damages.

Specific duties include:

- Notifying the insurer of a covered loss as defined under the policy of insurance

- Responding to claims in a timely manner

- Filing paperwork

- Communicating with policy holders

- Investigate liability

- Assess damages

- Research, detail and substantiate each aspect of the claim, including building damage, contents, and extra living expense claims.

- Prepare a detailed damages report based on monthly updated insurance cost software for the purpose of making an offer of settlement to the insured.

- If needed for specialty cost coding, negotiate with product/service providers on time and cost of repairs for the purpose of making an offer of settlement to the insured.

- Ensuring accurate procedures

- Protect the interest of the insurance company the adjuster represents, when dealing with claimants.

- Computer skills with a high degree of proficiency.

Some states now require adjusters disclose to claimants whose interest specifically independent, staff and public adjuster represent, before they proceed with the policyholder.

Always check your local chapter of Licensed Public insurance adjusters, or state agency, in order qualify an adjuster is properly licensed and in good standing. Some of the state chapters are AAPIA and NAPIA. In Florida, the chapter is FAPIA.

IEA conducts certified online classes for people. The Insurance Institute of America also provides training leading to professional designations. Some states accept the Associate of Claims designation, and will waive the licensing examination, and grant a license by the state insurance commission. Some insurance carriers, and independent adjusting companies provide in house training certified by the state insurance commission. They must be pre-approved by the licensing division. An adjuster license is issued to those that pass the requirements.

House Insurance Estimator Video

Education

Many insurance companies prefer their claims adjusters to have a 4-year college degree preferably in business related fields. In the past, high school graduates have become claims adjusters by promotion from within the claims department. Since there are no college majors for claims adjusters, many states require a state certification in order to practice as an adjuster. States also require that a certain number of continuing education credits for claims adjusters are earned each year in order to maintain their license. This continuing education is achieved by attending seminars and online training from different claim adjuster educational resources. There are also professional designations that have become prevalent among claims adjusters; for example, The American Institute for Chartered Property Casualty Underwriters awards the Chartered Property and Casualty Underwriter (CPCU) designation to experienced underwriters.

Florida is one of the few states in the United States that has created specific designations for the licensing of insurance claims adjusters. The Accredited Claims Adjuster Designation, created by statute in coordination with Polk State College in 2002, allows an individual to obtain the Florida All Lines Independent or Company license, without taking the state licensing exam.

In some instances, such as with collapse insurance, courts have been involved in order to predicate a reasonable understanding of the guidelines of the policy in question. The meaning of terms such as "collapse" have undergone rigorous constitutional assessment. This leads to some ambiguity between what the law says and what is enforceable by modern mandates. The idea of "Structural Integrity" may not always be a universally understood term, but several articles have been published on the topic which suggests the field is evolving toward a continuity in terminology. For those interested in the claims adjustment field, in-depth study of legal principle is a necessity.

Most states require licensed adjusters to continue their education through a "continuing education" requirement. Florida requires 24 hours of CE every two years.

Working conditions

Claims adjusters work long hours including work nights and weekends. Their work is appointment based and must revolve around the needs of clients.

Staff adjusters are those who work for a specific insurance company and usually have a company provided office from which to work. Independent and public claims adjusters often work from home. They receive their work assignments daily by fax machine, email, or by checking into a designated website. Staff adjusters receive their assignments when they arrive at the office first thing in the morning. In the case of a severe natural disaster such as floods or tornadoes, or other catastrophe, independent and public adjusters travel to the area to supplement local adjusters. Often this requires the incoming adjuster's presence in the field for days to weeks at a time.

Catastrophe adjusters may spend days to weeks in a hotel or RV near the field of operations. Husband and wife teams often enjoy this type of work as it allows them to work and travel together to different parts of the country. Adjusters should become familiar with the reimbursement rules for each company with whom they work and track all expenses used in the line of work. Keep your receipts for everything as virtually all expenses, while deployed in the field, are tax deductible (confer with a qualified tax specialist for specific advice on what is and isn't deductible as an expense). A good computer program or bookkeeping system is recommended.

Computer skills are essential, including keyboard skills. Most insurance companies store all documentation digitally. A digital camera is highly useful in documenting claims visually. Estimates, including auto and property losses, are prepared on computers connected to a corporate network. Laptop computers, pad, and other technologies make claims adjusting easier and consume less time. However, claims adjusting also requires a level of physical strength and stamina.

Property adjusters, for example, are often required to operate a 50-pound ladder and must stand, walk, kneel, crawl, and perform other physical demands as they investigate damaged property.

Are You Looking for Products

Here some products related to "Claims Adjuster".

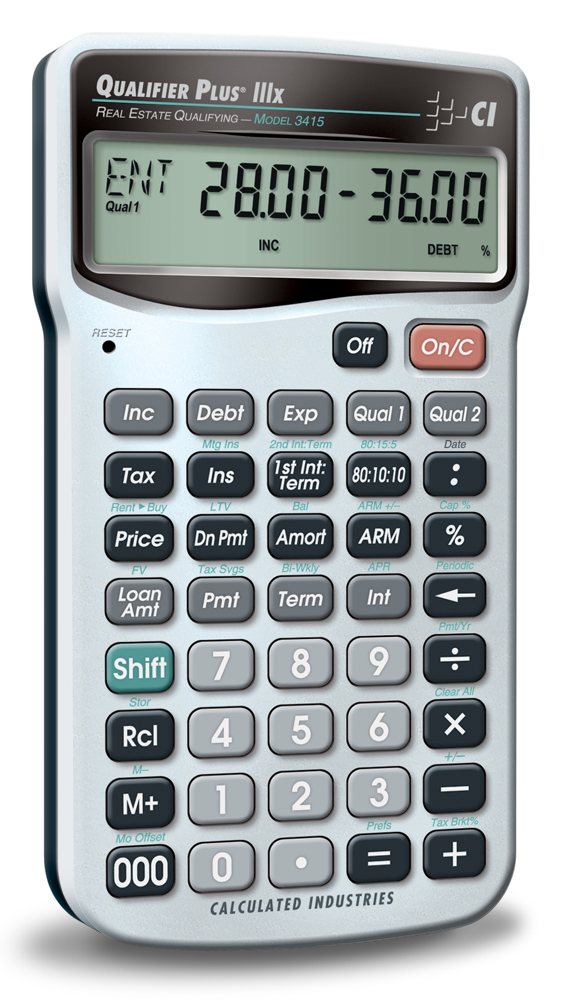

Calculated Industries 343..

Calculated Industries 341..

Mortgage Calculator and R..

Amazon Home Services : Am..

Get these at Amazon.com* amzn.to is official short URL for Amazon.com, provided by Bitly

Source of the article : here

EmoticonEmoticon