A short sale is a sale of real estate in which the proceeds from selling the property will fall short of the balance of debts secured by liens against the property, and the property owner cannot afford to repay the liens' full amounts and where the lien holders agree to release their lien on the real estate and accept less than the amount owed on the debt. Any unpaid balance owed to the creditors is known as a deficiency. Short sale agreements do not necessarily release borrowers from their obligations to repay any shortfalls on the loans, unless specifically agreed to between the parties. However, in California, legislation was passed to preclude deficiencies after a short sale is approved. The same is true of lenders on first loans and lenders on second loans -- once the short sale is approved, no deficiencies are permitted after the short sale. (SB 931, SB 458 - Calif. Code of Civil Procedure §580e).

A short sale is often used as an alternative to foreclosure because it mitigates additional fees and costs to both the creditor and borrower. Both often result in a negative credit report against the property owner. A similar procedure to a short sale in the UK is an Assisted Voluntary Sale (sometimes referred to as Assisted Voluntary Purchase)

Real estate industry data indicate that there were 2.2 million short sales in the United States during the period of the subprime mortgage crisis (December 2007) up to mid-2013.

Process

Most CBSU creditors require the borrower to prove he has an economic or financial hardship preventing him from paying the deficiency.

Creditors holding liens against real estate can include primary mortgages, junior lien holders--such as second mortgages, home equity lines of credit (HELOC) lenders, home owners association HOA (special assessment liens)--all of which will need to approve individual applications for a short sale, should they be asked to take less than what is owed.

Most large creditors have special loss mitigation departments that evaluate borrowers' applications for short sale approval. Often creditors use pre-determined criteria for approving the borrowers and the terms of the sale of the properties. Part of this process typically includes the creditor(s) determining the current market value of the real estate by obtaining an independent evaluation of the property with an appraisal, a Broker's Price Opinion, or a broker opinion of value (BOV). One of the most important aspects for the borrower in this process is putting together a proper real estate short-sale package, including hardship letter explaining why a short sale is needed.

Depending on each creditor's policy and the type of loan, a creditor may accept an application from a borrower even if the borrower is not in default with one's payments. The overwhelming number of defaulting borrowers during the 2008-2012 global financial crisis led many creditors to become adept at processing such short sales applications, yet the process can still take several months, often requiring several levels of approval.

Sell Your House Quick Video

Additional parties

Some junior lien holders and others with an interest in the property may object to the amounts other lien holders are receiving. It is possible for any one lien holder to prevent a short sale by refusing to agree to negotiate a reduction in their payoff to release their lien. (Iowa has a procedure, sale free of liens, which allows a foreclosure court to "cram down" a short sale over the objections of the junior creditors.) If a creditor has mortgage insurance on their loan, the insurer will likely also become a third party to these negotiations, since the insurance policy may be asked to pay out a claim to offset the creditor's loss. The wide array of parties, parameters and processes involved in a short sale can make it a complex and highly specialized form of debt renegotiation. Short sales can have a high risk of failure from inability to obtain agreement from all parties, or they might not be approved in time to prevent a scheduled foreclosure date.

Services and consultants

Homeowners who wish to short sell their homes may select their own real estate agents or brokers when doing a Home Affordable Foreclosure Alternatives (HAFA) short sale. This is the case for traditional short sales as well. Real estate commission is a seller expense typically paid by the short sale lender from the sale proceeds. Chase HAFA Short Sale FAQ's Real estate agents or brokers will sometimes enlist the help of a third party negotiator to handle getting lender consent and lien releases for any junior liens, but that is not typically an allowed expense.

In the United States, the Federal Trade Commission (FTC) and individual states license and regulate debt negotiators and other consultants who, for a fee, advise borrowers and negotiate loan modifications with creditors on the borrower's behalf. These consultants are required by various laws to disclose to borrowers the risks of renegotiating their mortgages and/or selling their property short.

Credit implications

A short sale negotiation resulting in a reduction of the amount a borrower owes towards a debt acts as a type of settlement or renegotiation of a borrower's debt. Should the creditor report the debt reduction to credit reporting agencies, it can adversely affect a person's credit report. Despite significant misreporting on the topic, damage to one's credit due to a short sale is really no different from that of a foreclosure. After a short sale, borrowers may find it difficult to obtain a new mortgage because lender's underwriting guidelines might reject lending to a borrower who has obtained a short sale in the past. As of 2011, national and state laws and industry standards for both real estate sales and lending are in an ongoing and rapid state of change. Borrowers interested in pursuing a short sale should consult first with a HUD-approved mortgage counselor for up-to-date and specific advice as it applies to their situation. Also, borrowers need to obtain up-to-date information from multiple professionals, including an accountant, an attorney, and a real estate broker--all of whom should be specialized in loss mitigation and should be licensed to practice in the state where the real estate is located.

On August 15, 2013, the Federal Housing Administration instituted a new program called "Back-To-Work-Extenuating Circumstances" to assist potential borrowers who faced financial hardship during the recession. This program provides a second chance for mortgage applicants who have experienced financial hardship such as unemployment or a severe reduction in income beyond the borrower's control. This program is designed to assist borrowers with a recent history of foreclosure, judgment, short sale, bankruptcy, loan modification, or deed-in-lieu by acknowledging that their credit history may not fully reflect their ability or propensity to repay a mortgage. Prospective borrowers who have experienced an economic event and can document that the event was out of their control, that they have recovered, and that they have completed housing counseling can apply for an FHA-insured mortgage that will allow up to 96.50% financing.

Steps can be taken by homeowners after doing a short sale to get them back on track to getting a mortgage again. The homeowner is advised to obtain a letter from the lender confirming that the loan closed in a short sale, not a foreclosure; and to order a copy of his/her credit report from all three bureaus. Lastly, the homeowner should get pre-approved. This is where the lender will check current guidelines to see if the homeowner is qualified to obtain a mortgage. It is also important for a homeowner considering a short sale to consult an accountant or tax attorney as well. Since a successful short-sale will ultimately reduce the debt of a homeowner, the IRS considers the reduction of debt as income, resulting in certain tax implications.

Fraud

In 2010 CNBC reported on a story from entrepreneur Jeremy Brandt that some creditors have been accused of engaging in fraud during the short sale process. One type of short sale fraud has involved creditors in second position obtaining kickbacks in the form of cash payments from a buyer or real estate agent which was not disclosed to the other creditors.

Questions you will be asked when considering a Short Sale

- Is your home currently on the market? If so. do you have it listed with a real estate agent?

- Who is your mortgage company/lender?

- What kind of loan do you have? (FHA. USDA. VA. Conventional. Home Equity)

- Is there more than one mortgage lien on your property? (2nd Lien. 3rd Lien. Etc.) If so who are the lenders on the other liens?

- How many months behind on payments are you?

- When did you purchase your home?

- How much did you originally pay for your home?

- How much do you currently owe?

- Have you taken out a home equity loan? If so, when?

- Who is on the mortgage note? (husband, wife, parent, relative, co-signer, etc.)

- Who is on title to the property?

- Where is your home located? Address?

- What is the condition of the property? (Does it need repairs, if so list them out in detail)

- Are you currently living in the property? If no, where are you currently living?

- Are the utilities still on at the property?

- If you have moved out, are you currently renting it out to someone else?

- Are you current on your utilities? What about Homeowner Association (HOA) Dues? If not current. how much is owed?

- If the situation is related to a divorce or separation, has the other spouse moved out? Will the other spouse be cooperative in signing paperwork?

- Are there any outstanding judgments and/or liens that you are aware of? (i.e. missed lease payments from a previous property, city or state violations with an associated unpaid fine issued to the property, unpaid utility bills, property and income tax)

- What correspondence have you received from your lender? Certified Letters? Notice of Default? Notice of Acceleration? Notice of Foreclosure Proceedings?

- What is the date of the last correspondence?

Are You Looking for Products

Here some products related to "Short Sale (real Estate)".

Sell Your House In A Mont..

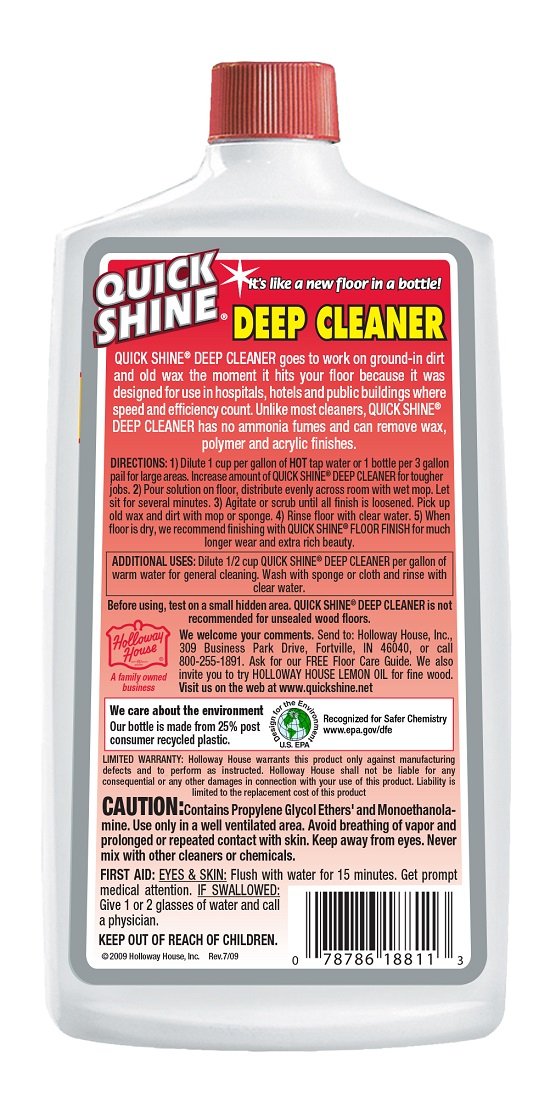

Amazon.com - Quick Shine ..

Flower House SHXL800 Stor..

Amazon.com - Quick Shine ..

Get these at Amazon.com* amzn.to is official short URL for Amazon.com, provided by Bitly

Source of the article : here

EmoticonEmoticon