Adjusted cost base (ACB) is a calculation used to determine the cost of an investment for tax purposes. The Canada Revenue Agency requires investors to use the ACB calculation when determining capital gains or losses for income tax purposes on Schedule 3.

Uses

In Mutual Funds:

In some cases, ACB is presented as ACB/unit:

Note: These are simplified equations. In some case, other values are included (ex. commission fees)

It is possible that the ACB might never change if there are no additions or disposals following the initial purchase amount. However, any additions or subtractions to the initial investment needs to be plugged into the above equations since it will have an effect on the ACB. It is for this reason that ACB is recalculated after each transaction.

Dividends that are cashed out and not reinvested don't change the ACB. A redemption will not change the ACB/unit but the reduction of the total unit cost for a redemption is calculated as ACB x units sold. It is not the market value of the units sold.

Dividends that are deemed/notional will increase the ACB but will not change the number of units held, nor will it change the overall market value.

An increase in the ACB will reduce the amount of capital gains realized at time of disposition. Deferred Sales Charge (DSC) charged at time of redemption will not impact the ACB. However, the amount of DSC charged may be claimed as an expense when filing the "Capital gains (or losses)" section of the income tax return.

In Selling Property:

The calculation of ACB for property is complicated by numerous exceptions too complex to discuss in this forum. Please see the Canada Revenue Agency definition

Capital improvements made to a property are added to the ACB of the property. Capital improvements generally extend the life of a property and specifically exclude routine repairs and maintenance.

Acquisition costs (also referred to as closing costs) increase the ACB of a property. Acquisition costs include legal fees, land transfer tax, land surveys and property inspections.

Interest paid on debt used to acquire vacant land is added to the ACB of the land.

Are You Looking for Products

Here some products related to "Adjusted Cost Base".

Calculated Industries 851..

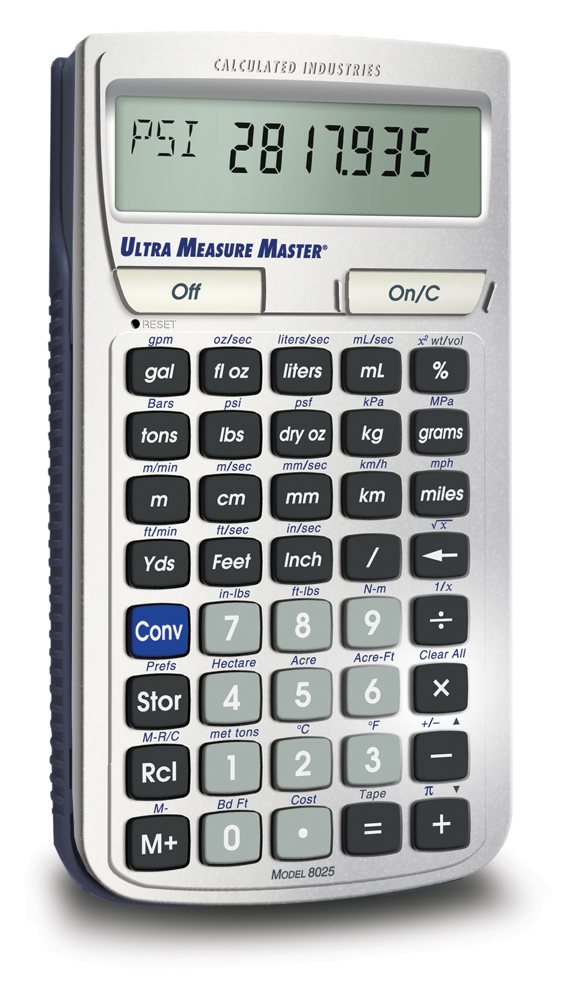

Calculated Industries 802..

Calculated Industries 851..

Calculated Industries 432..

Get these at Amazon.com* amzn.to is official short URL for Amazon.com, provided by Bitly

Source of the article : here

EmoticonEmoticon