The Federal Housing Finance Agency (FHFA) is an independent federal agency created as the successor regulatory agency resulting from the statutory merger of the Federal Housing Finance Board (FHFB), the Office of Federal Housing Enterprise Oversight (OFHEO), and the U.S. Department of Housing and Urban Development government-sponsored enterprise mission team, absorbing the powers and regulatory authority of both entities, with expanded legal and regulatory authority, including the ability to place government sponsored enterprises (GSEs) into receivership or conservatorship.

In its role as regulator, it regulates Fannie Mae, Freddie Mac, and the 12 Federal Home Loan Banks (FHLBanks, or FHLBank System). It is wholly separate from the Federal Housing Administration, which largely provides mortgage insurance.

History

The law establishing the FHFA is the Federal Housing Finance Regulatory Reform Act of 2008, which is Division A of the larger Housing and Economic Recovery Act of 2008, Public Law 110-289, signed on July 30, 2008 by President George W. Bush. One year after the law was signed, the OFHEO and the FHFB went out of existence. All existing regulations, orders and decisions of OFHEO and the Finance Board remain in effect until modified or superseded.

On the day of the law's signing, former Director James Lockhart stated:

"For more than two years as Director of OFHEO I have worked to help create FHFA so that this new GSE regulator has far greater authorities than its predecessors. As Director of FHFA, I commit that we will use these authorities to ensure that the housing GSEs provide stability and liquidity to the mortgage market, support affordable housing and operate safely and soundly.

FHFA director Lockhart transmitted a "notice of establishment," for publication in the Federal Register on September 4, 2008. The notice formally announced the agency's existence and authority to act.

Conservatorships

On September 7, 2008, FHFA director Lockhart announced he had put Fannie Mae and Freddie Mac under the conservatorship of the FHFA. The action is "one of the most sweeping government interventions in private financial markets in decades". U.S. Treasury Secretary Henry M. Paulson, appearing at the same press conference, stated that placing the two GSEs into conservatorship was a decision he fully supported, and said that he advised "that conservatorship was the only form in which I would commit taxpayer money to the GSEs." He further said that "I attribute the need for today's action primarily to the inherent conflict and flawed business model embedded in the GSE structure, and to the ongoing housing correction."

In the announcement, Lockhart indicated the following items in the plan of action for the conservatorship:

Suits against financial institutions

The FHFA in 2011 filed suit first against UBS then against 17 other financial institutions accusing them of misrepresenting about $200 billion in mortgage-backed securities sold to Fannie Mae and Freddie Mac. The suits, some of which name individual defendants, allege a variety of violations of federal securities law and common law and paint "a damning portrait of the excesses of the housing bubble." The suits seek a variety of damages and civil penalties.

Housing Finance Agency Video

FHFA settlements for fraudulent sales by PLS to Fannie Mae and Freddie Mac

The Federal Housing Finance Agency initiated litigation against 18 financial institutions involving allegations of securities law violations and, in some instances, fraud in the sale of private-label securities (PLS) to Fannie Mae and Freddie Mac.

Below is a list of the cases, with amounts of any settlements reached in 2013 and 2014.

1. General Electric Company $6.25 million 2. CitiGroup Inc. $250 million 3. UBS Americas, Inc. (Union Bank of Switzerland) $885 million

4. J.P. Morgan Chase & Co. $4 billion 5. Deutsche Bank AG $1.925 billion 6. Ally Financial, Inc. $475 million

7. Morgan Stanley $1.25 billion 8. SG Americas (Societe Generale) $122 million 9. Credit Suisse Holdings (USA) Inc. $885 million

(10. Bank of America Corp. 11. Merrill Lynch & Co. 12. Countrywide Financial Corporation $5.83 billion)

13. Barclays Bank PLC $280 million 14. First Horizon National Corp. $110 million 15. RBS Securities, Inc. (in Ally action) $99.5 million

16. Goldman Sachs & Co. $1.2 billion 17. HSBC North America Holdings, Inc. (Hong Kong Shanghai Banking Corp.) $550 million

Non-Litigation PLS Settlements Wells Fargo Bank, N.A. $335.23 million

Leadership

Upon Lockhart's departure, Edward J. DeMarco was appointed Acting Director of FHFA on August 25, 2009.

On May 1, 2013, President Barack Obama nominated Mel Watt as the next FHFA head. After Democrats eliminated rules allowing filibusters on executive branch nominations, the U.S. Senate confirmed Watt on December 10, 2013.

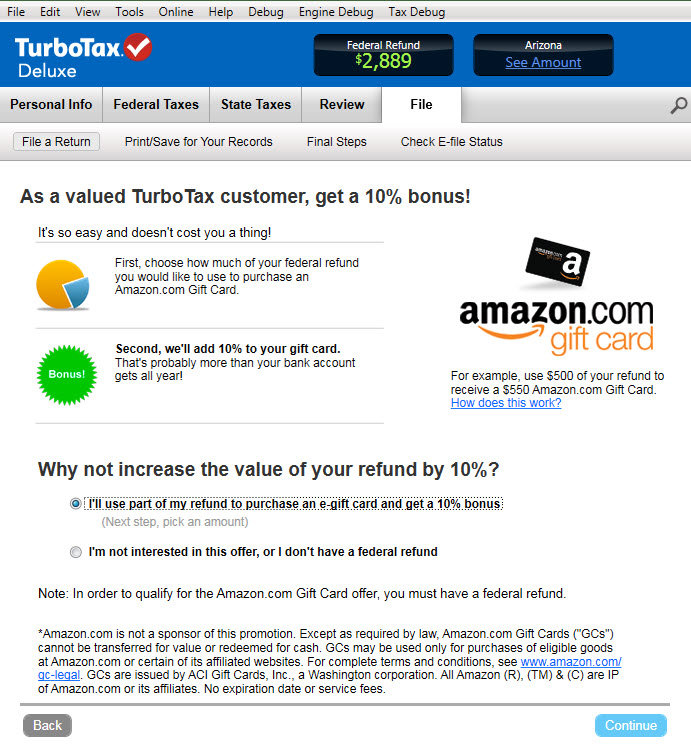

Are You Looking for Products

Here some products related to "Federal Housing Finance Agency".

Mortgage Backed Securitie..

Influx: Daniel Suarez: 97..

TurboTax Deluxe Fed + Efi..

Get these at Amazon.com* amzn.to is official short URL for Amazon.com, provided by Bitly

Source of the article : here

EmoticonEmoticon